Employee reimbursements are a pain point for fast-growing teams and remote-first companies. From chasing receipts to managing spreadsheets and handling bank transfers, the traditional process is slow, inefficient, and error-prone.

But there’s a better way:

Prepaid card issuing is transforming how businesses handle employee expenses, offering instant control, real-time visibility, and a modern user experience.

Let’s explore how this works, and how platforms like Yativo are helping companies in Latin America and beyond replace reimbursements with smarter prepaid solutions.

The Problem with Traditional Reimbursements

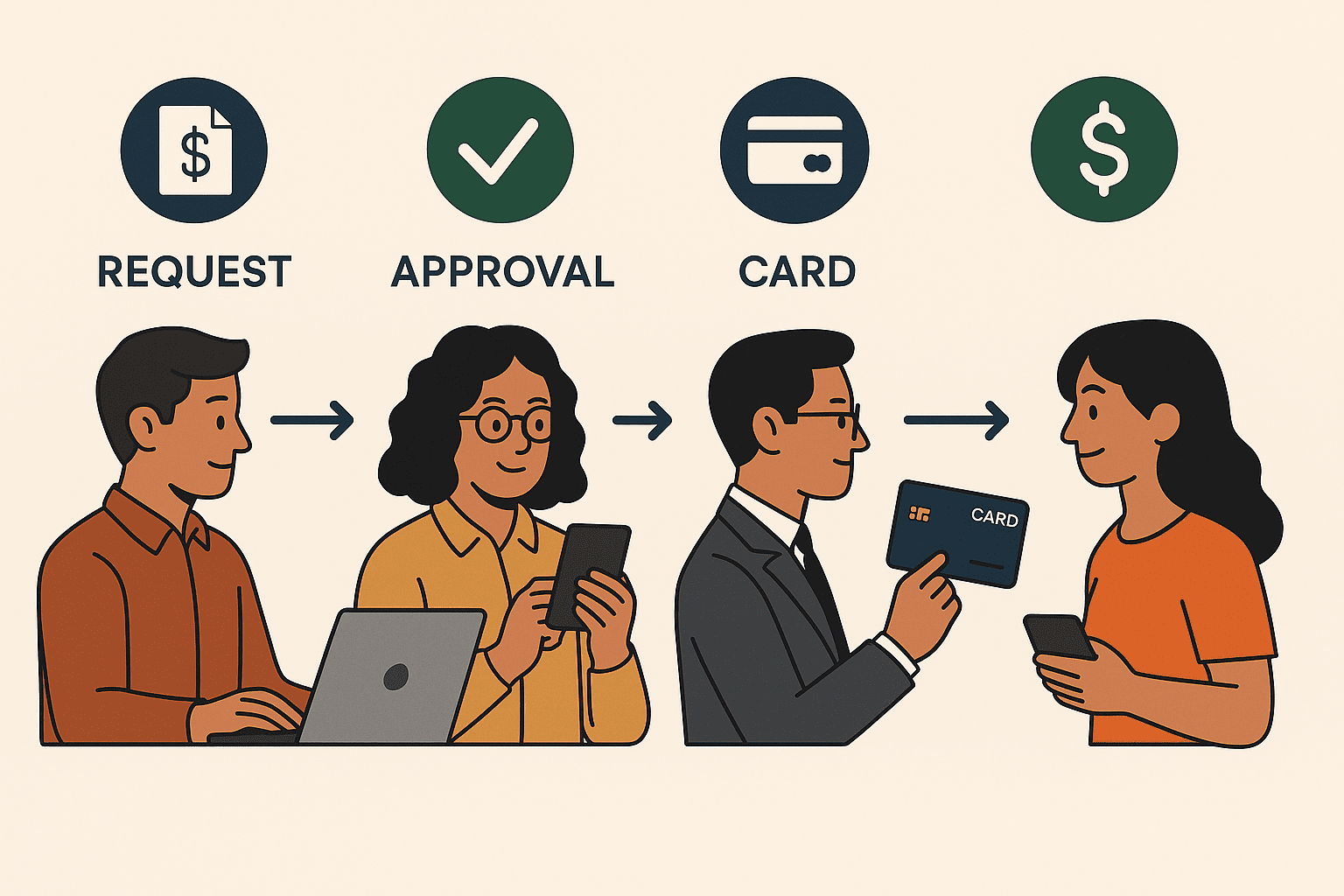

Whether you’re running a startup or managing a remote team, the typical reimbursement workflow looks like this:

- Employee pays out-of-pocket

- Submits receipts via email or shared folder

- Manager approves manually

- Finance processes payment

- Employee receives refund days or weeks later

This process causes multiple problems:

- ⏱️ Delays that frustrate employees

- 📉 Lack of real-time visibility into spending

- 🔁 Manual work for finance teams

- 💸 Expense fraud risk due to lack of controls

- 💼 Poor experience for remote or field workers

The Solution: Prepaid Cards for Employee Spend

By issuing prepaid virtual cards, companies can give employees access to approved funds before they spend, eliminating reimbursements entirely.

✅ Preloaded Funds

Assign funds for travel, subscriptions, office supplies, or department budgets.

✅ Real-Time Control

Set limits, merchant categories, or one-time use cards; all through an API or dashboard.

✅ Instant Issuance

Employees receive a virtual card instantly. No delays or shipping issues.

✅ Full Visibility

Every transaction is trackable, categorized, and exportable for reporting or audits.

Why It’s Ideal for LATAM and Remote Teams

In Latin America, where banking infrastructure can be fragmented and not every employee has a corporate card, virtual prepaid cards offer:

- 💳 A practical way to issue spending tools without opening bank accounts

- 📱 Mobile-first usability for employees in the field or working remotely

- 🧾 Easier tax compliance and digital recordkeeping

- 🌐 Borderless support for distributed teams or cross-border subsidiaries

How Yativo Makes It Simple

Yativo Card Issuing lets you launch prepaid VISA virtual cards, funded by USDC or USDT, with full programmatic control.

With Yativo, you can:

- Create and issue cards per employee or department

- Set spending limits (up to $10,000 USD per card)

- Fund cards via stablecoin deposits to your Yativo USD wallet

- Track all transactions in real time

- Reward spending with monthly cashback in $TIVO tokens

Cards are virtual-only, for online use, making them perfect for digital tools, subscriptions, and e-commerce — not in-store purchases or POS terminals.

Use Cases for Prepaid Expense Cards

| Scenario | How It Helps |

|---|---|

| Remote Employees | Fund digital work tools and subscriptions |

| Travel Expenses | Issue per-trip cards with fixed budgets |

| Marketing Teams | Preload budgets for ads or sponsorships |

| Procurement | Enable staff to order supplies online |

| Freelancers or Contractors | Provide a controlled way to manage reimbursements |

Real Impact

Teams that switch to prepaid card issuing:

- Reduce admin time spent on expense approvals

- Gain real-time oversight on company spend

- Improve employee satisfaction by eliminating out-of-pocket stress

- Prevent fraud and overspending with built-in controls

Final Thoughts

Reimbursements are broken. Prepaid card issuing offers a smarter way forward, with faster workflows, better oversight, and a better experience for both employees and finance teams.

Yativo’s virtual prepaid cards are purpose-built for remote-first, stablecoin-powered businesses that want to streamline operations without adding banking complexity.

👉 Learn more about Yativo Card Issuing

👉 Contact us to launch your expense card program