If you run a business in Chile and serve U.S.-based clients, you’ve probably asked:

“How do I get paid from the U.S. without losing a big chunk to fees or delays?”

Whether you’re a software company, export business, freelancer collective, or digital agency, receiving international business payments is crucial for cash flow and growth.

This guide breaks down the best ways to accept business payments from the U.S. to Chile, compares popular solutions, and shows how Yativo can simplify the process, with instant settlement, fair FX rates, and no U.S. entity needed.

🔍 The Problem

U.S. clients often want to pay in USD via:

- ACH transfers (local U.S. rails)

- Wire transfers (SWIFT)

- Credit cards

- Payment platforms like PayPal or Stripe

But as a Chilean company, you face several challenges:

- ❌ You can’t accept ACH without a U.S. bank account

- ❌ SWIFT wires are slow and expensive

- ❌ Stripe and PayPal hold funds and charge high fees

- ❌ Converting USD to CLP can be opaque and costly

✅ What You Actually Need

To make this work smoothly, you want a solution that:

- Lets your U.S. clients pay in USD easily

- Offers a transparent FX conversion

- Delivers CLP to your Chilean bank account fast

- Doesn’t require setting up a U.S. legal entity

- Is legally compliant and easy to integrate with your invoicing solution via APIs

🛠️ Top 4 Ways to Accept U.S. Business Payments in Chile

1. Wise Business

How it works:

- You get a U.S. receiving account (ACH-enabled)

- Client transfers USD via ACH or wire

- You convert to CLP and withdraw to your Chilean account

Pros:

✅ Low FX fees

✅ Great for freelancers and small teams

Cons:

❌ Takes 1-2 business days to receive the funds

❌ Does not support most industries

❌ Cannot be integrated to your website or your local invoicing/accounting software

2. Payoneer

How it works:

- Offers USD account details for receiving payments

- Clients can pay you as if you’re in the U.S.

- You withdraw in CLP to your Chilean bank account

Pros:

✅ Easy for B2B U.S. payments

✅ Large platform support (Amazon, Upwork, etc.)

Cons:

❌ FX fees can reach 2–3%

❌ Does not support payments from your own account, or from an individual

❌ Not really API friendly

❌ Does not support most industries

3. Traditional Bank Wires

How it works:

- Client sends a USD wire to your Chilean company’s bank

- Bank applies international wire fees and FX spread

- CLP deposited into your local account

Pros:

✅ Familiar for large B2B clients

Cons:

❌ High SWIFT fees (up to $50+)

❌ FX spreads can be 3–5%

❌ Settlement can take 3–5 days

❌ Difficult to reconcile

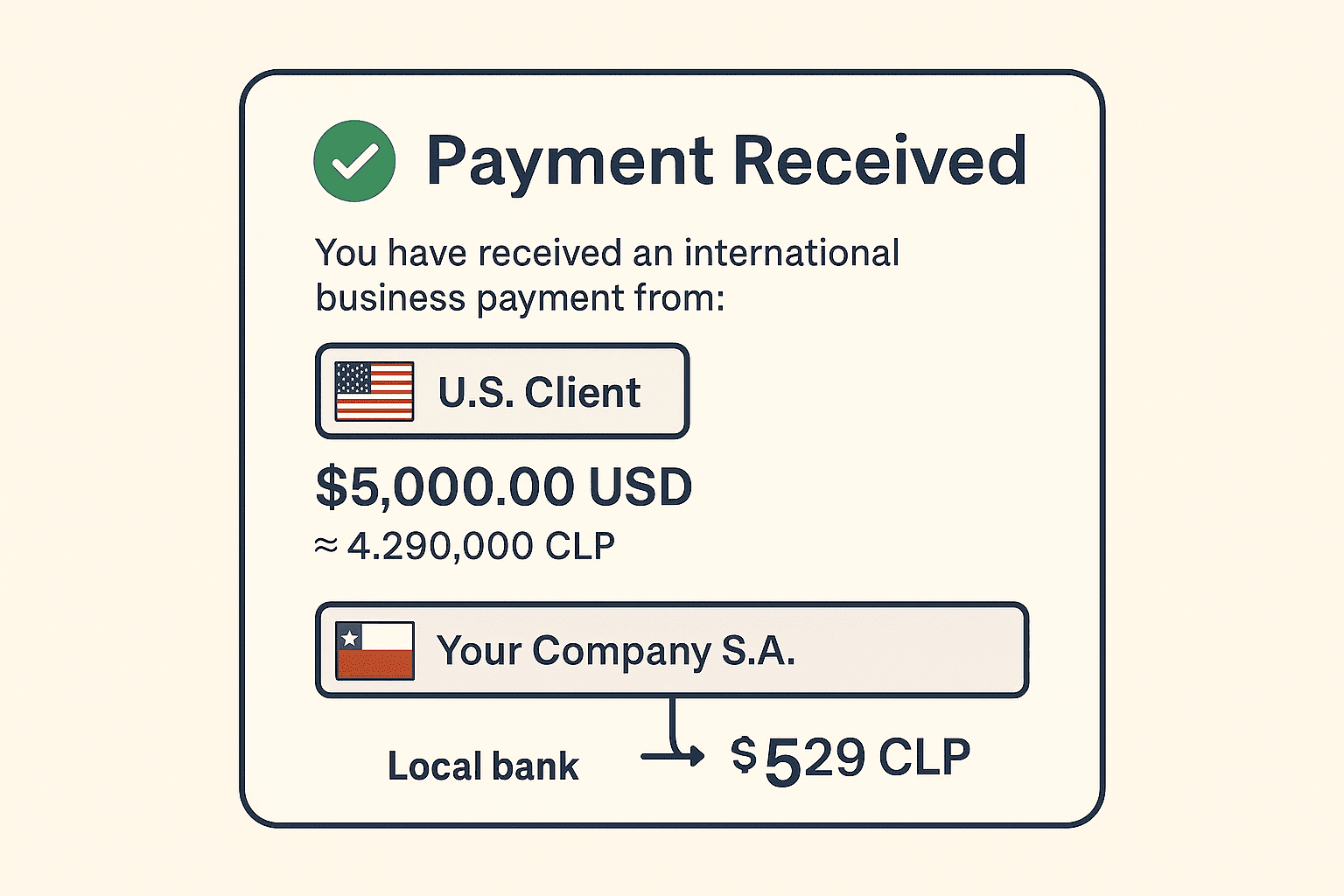

4. Yativo (Recommended)

How it works:

- You create a US Bank account in your own name, or that of your clients/department (suitable for large businesses or marketplaces)

- Client sends USD via ACH or wire to the bank account

- Yativo settles you in USDC/USDT if crypto-native, or in USD

- You initiate a CLP to your Chilean Bank Account

- Yativo settles the amount instantly to your Chilean bank account

Pros:

✅ Accept USD from U.S. clients without a U.S. Entity

✅ Crypto FX rates

✅ Instant CLP payouts to ALL CHILEAN BANKS, weekends inclusive

✅ API to generate payment links, track invoices, and trigger payouts

✅ Works great for companies of all sizes

Cons:

❌ Not designed for micro/individual use cases

❌ May require having a developer as it is API first

💡 Example Use Case

You run a Chilean agency billing $3,000/month to a U.S. startup:

- With Wise: They ACH to your Wise account, then you convert to CLP at ~0.5–1.0% FX cost and withdraw in 1–2 days

- With Payoneer: Similar process, but with higher FX margins (~2–3%)

- With Yativo: Client wires USD to your Yativo account → you withdraw CLP to your Chilean bank account within minutes.

📊 Comparison Table

| Feature | Wise | Payoneer | Traditional Bank | Yativo |

|---|---|---|---|---|

| U.S. Client Pays in USD | ✅ | ✅ | ✅ | ✅ |

| CLP Withdrawal | ✅ | ✅ | ✅ | ✅ |

| Crypto Friendly | ❌ | ❌ | ❌ | ✅ |

| Integration to Local ERP | ❌ | ❌ | ❌ | ✅ |

| Developer API | ❌ | ❌ | ❌ | ✅ |

| Best For | Freelancers | SMEs | Large clients | SaaS / Fintechs / Marketplaces |

🚀 Final Thoughts

U.S. clients want to pay in USD, and you want those funds in CLP, quickly and with minimal cost.

- Wise works well if you want simplicity

- Payoneer is decent for platforms but more expensive

- SWIFT wires are clunky and outdated

- Yativo is the best all-around option for Chilean companies that want programmable, fast, and fair payment flows from the U.S.

👉 Explore Yativo’s payment collection tools

👉 Talk to our team to receive U.S. business payments in Chile — without the hassle