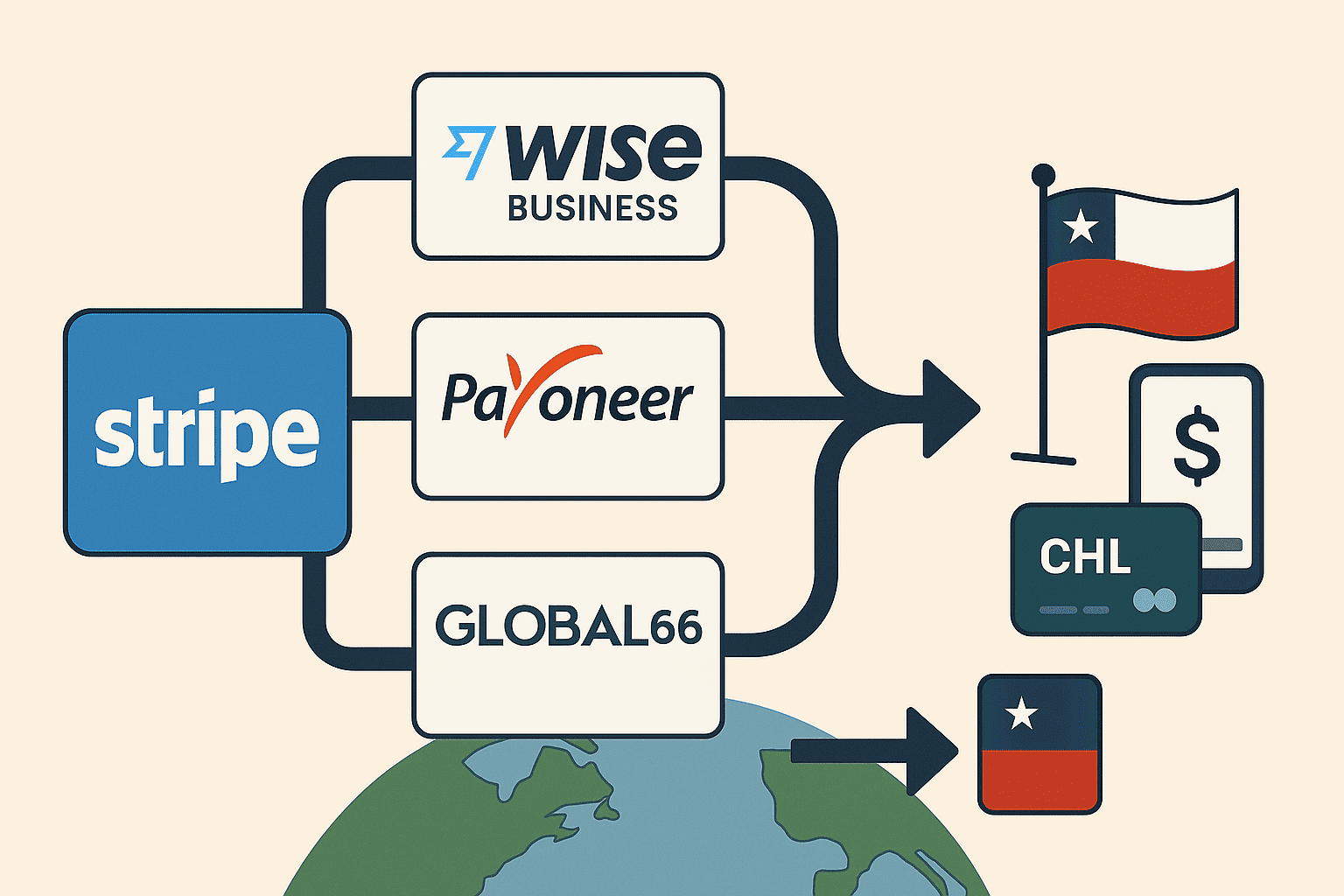

If you’re a Chile-based business receiving payments from Stripe (or other U.S.-based platforms), you may face hurdles when trying to move funds into local pesos, especially if you don’t have a U.S. entity. Here’s a deep dive into how to solve it using four top solutions.

1. Wise Business

✅ Local USD receiving + conversion to CLP

- Get a U.S. routing number and account via Wise (with a one-time setup fee) (wise.com)

- Stripe can send payouts directly via ACH to this account

- Wise converts USD to CLP at near–mid-market FX, typically within 1 business day (wise.com)

- Add CLP balance and withdraw to Chilean bank account

- Fees: no receipt fee (ACH is free), conversion fee ranges (generally lower than traditional banks)

Drawbacks

- Must verify for USD account

- Settlement isn’t instant, often 1–2 days

- Not suitable for large amounts, and most users complain of their accounts being blocked at random.

- Not crypto friendly

2. Payoneer

✅ Multi-currency receiving + local CLP withdrawal

- Request a USD receiving account via Payoneer

- Stripe payouts land here; you can send withdrawals to your CLP bank account (payoneer.com, wise.com, payoneer.com)

- Payoneer charges 2–3 % FX margin + withdrawal fees (payoneer.com)

- Supports mass payouts and prepaid Mastercard access for spending

- Fees: variable depending on currency flows

Drawbacks

- Higher FX spread compared to Wise

- Local Chilean withdrawal times up to 2 business days

- Can only receive payments from business accounts, and the account sending must not be in your name

- Not crypto friendly

3. Global66

✅ Latin America–centric FX provider

- A Chilean-founded fintech offering USD collection and conversion

- Accepts small-median US transfers, offers CLP liquidity within 1 business day

- Charges a FX spread markup over mid-market

- Ideal for low-value, frequent transfers to Chile

Drawbacks

- Less suited for high-volume business payouts

- Primarily for individual or SME use

- No API functionality

- Not crypto friendly

4. Yativo

✅ Helps LATAM Companies Handle Cross-Border Payments

- Create a USD Bank Account for your business using Yativo and use it to receive payments from Stripe

- Optional conversion to CLP (or USDC) with real-time FX

- Instant Payout to ALL Chilean bank (CuentaRUT, CuentaCorriente, Banco de Chile, etc) instantly via API or dashboard

- Issue per-invoice named USD Bank accounts for automated reconciliation

- Fees: Based on volume

- Developer-friendly: full REST API, webhooks, and metadata support for transaction-level matching

Why It Outperforms Others

- Create multiple bank account numbers for each invoice

- Lightning-fast settlement via local rails

- Transparent FX rates

- All-in-one flow: “USD-in → CLP-out”

Feature Comparison

| Feature | Wise Business | Payoneer | Global66 | Yativo |

|---|---|---|---|---|

| USD Receiving Account | ✔️ | ✔️ | ✔️ | ✔️ |

| FX Spread | ~0.3–1% | ~2–3% | ~1–2% | Transparent real-time |

| Withdraw to CLP | 1–2 days | 1–2 days | ~1 day | Instant via API |

| Per-payment unique Account | ❌ | ❌ | ❌ | ✅ Create as many accounts as you need |

| API/Automation | Basic | Limited | None | ✅ Full REST + webhooks |

| Fees | Low | Moderate | Mixed | Low |

| Best For | SMEs, freelancers | Marketplaces / freelancers | Personal/small biz | Businesses of all sizes |

Final Recommendations

- Use Wise if you just need low-cost conversion with moderate reconciliation needs.

- Use Payoneer if you only receive from businesses and can wait 2-3 days to get settled.

- Use Global66 for lower-value, non-business flows into CLP.

- Use Yativo if you collect frequent business payments from the US to your Chilean Bank, especially if they are large payments.

Wrapping Up

If you don’t have a U.S. entity but receive USD from Stripe:

- Wise and Payoneer are solid, but fall short on per-payment tracking.

- Global66 helps with small transfers, but lacks business features.

- Yativo offers a purpose-built, developer-first solution with unique CLABEs to simplify USD collection and CLP payouts—perfect for SaaS, marketplaces, and any platform needing clear, automated reconciliation.

👉 Learn more about Yativo’s Virtual Account flows

👉 Contact Yativo Sales to see a live demo