If you’re a freelancer, consultant, or small business in Chile working with international clients, Payoneer is likely one of your go-to tools for receiving payments in USD.

But when it comes time to withdraw those dollars into your local Chilean bank account, things can get expensive and slow, especially if you don’t pay attention to FX fees and processing times.

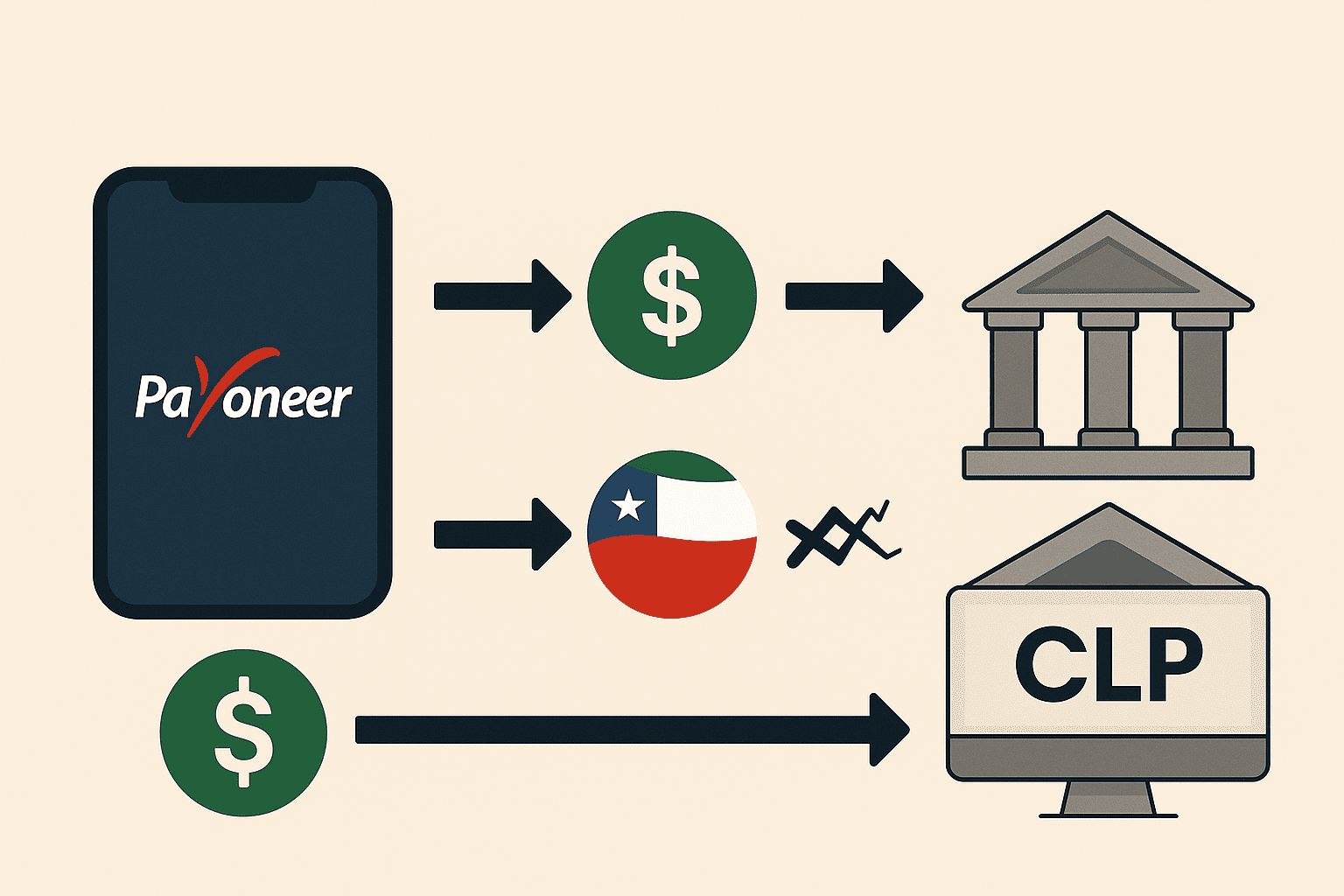

This guide explains the best ways to withdraw USD from Payoneer to a Chilean bank account (in CLP), how much it costs, and alternative routes that may save you money.

🏦 How Payoneer Works in Chile

Payoneer gives you a USD virtual receiving account, similar to a U.S. bank account. Platforms like Upwork, Fiverr, or direct clients can pay you in USD.

To withdraw to Chile:

- You convert the USD to Chilean pesos (CLP) using Payoneer’s platform

- Funds are then sent to your local Chilean bank (BancoEstado, Santander, BCI, etc.)

💰 Step-by-Step: Withdrawing to Chilean Bank

- Log into Payoneer

- Go to “Withdraw” → “To Bank Account”

- Select your USD balance

- Enter the CLP bank account you’ve already linked

- Review the conversion rate and confirm

💡 Payoneer does not offer direct USD withdrawals to Chile, funds must be converted to CLP.

📉 The Hidden Cost: FX Spread

Payoneer applies a currency conversion fee on top of the exchange rate. As of 2024:

- FX margin: ~2% to 3% over the mid-market rate

- Additional withdrawal fees: None for standard bank withdrawals

For example, if the mid-market rate is 1 USD = 900 CLP, Payoneer might give you 873–882 CLP per dollar.

🧾 Over time, this FX margin can cost you $20–$50+ per $1,000 withdrawn.

⏱️ Withdrawal Time

- Typical processing time: 1 to 2 business days

- You’ll receive a confirmation email once funds are released

- Final CLP credit depends on your bank’s processing speed

🔁 Better Alternatives to Reduce Fees or Improve Speed

1. Wise (formerly TransferWise)

Withdraw from Payoneer to your Wise USD account, then convert USD to CLP at mid-market rates.

- FX margin is ~0.5%

- Transparent fees

- Faster delivery to Chilean banks

✅ Best for freelancers wanting more control over FX

2. Yativo (for businesses and platforms)

Withdraw from Payoneer to your Yativo USD virtual account, then convert USD to CLP at crypto-market rates.

- Transparent FX rates

- Instant payout to any Chilean bank

- Built-in API for automated reconciliation

✅ Ideal for platforms, marketplaces, agencies, web3, SaaS companies, and high-volume flows

🧮 Comparison Table

| Feature | Payoneer | Wise | Yativo |

|---|---|---|---|

| FX Margin | 2–3% | ~0.5% | Transparent |

| CLP Payout | Yes | Yes | Yes |

| USD Withdrawal to Chile | ❌ (CLP only) | ❌ | ✅ via Yativo flow |

| API / Automation | ❌ | Limited | ✅ Full REST |

| Settlement Time | 1–2 days | 1 day | Instant |

| Best For | Freelancers | Cost-conscious users | Businesses / platforms |

✅ Best Practices

- Check FX rate before confirming withdrawal

- For large transfers, compare Payoneer vs Wise vs Yativo rates

- If you’re building a platform or managing payouts for others, use Yativo for better automation, traceability, and FX control

Final Thoughts

Payoneer is convenient, but the FX fees can quietly eat into your income. For small transfers, it’s fine. For larger amounts or frequent withdrawals, alternatives like Wise or Yativo can save you time and money.

👉 Want real-time FX, instant Chilean bank settlement, and full control over your USD? Check out Yativo

👉 Already using Wise or Payoneer? Yativo can plug in and settle your payouts seamlessly.