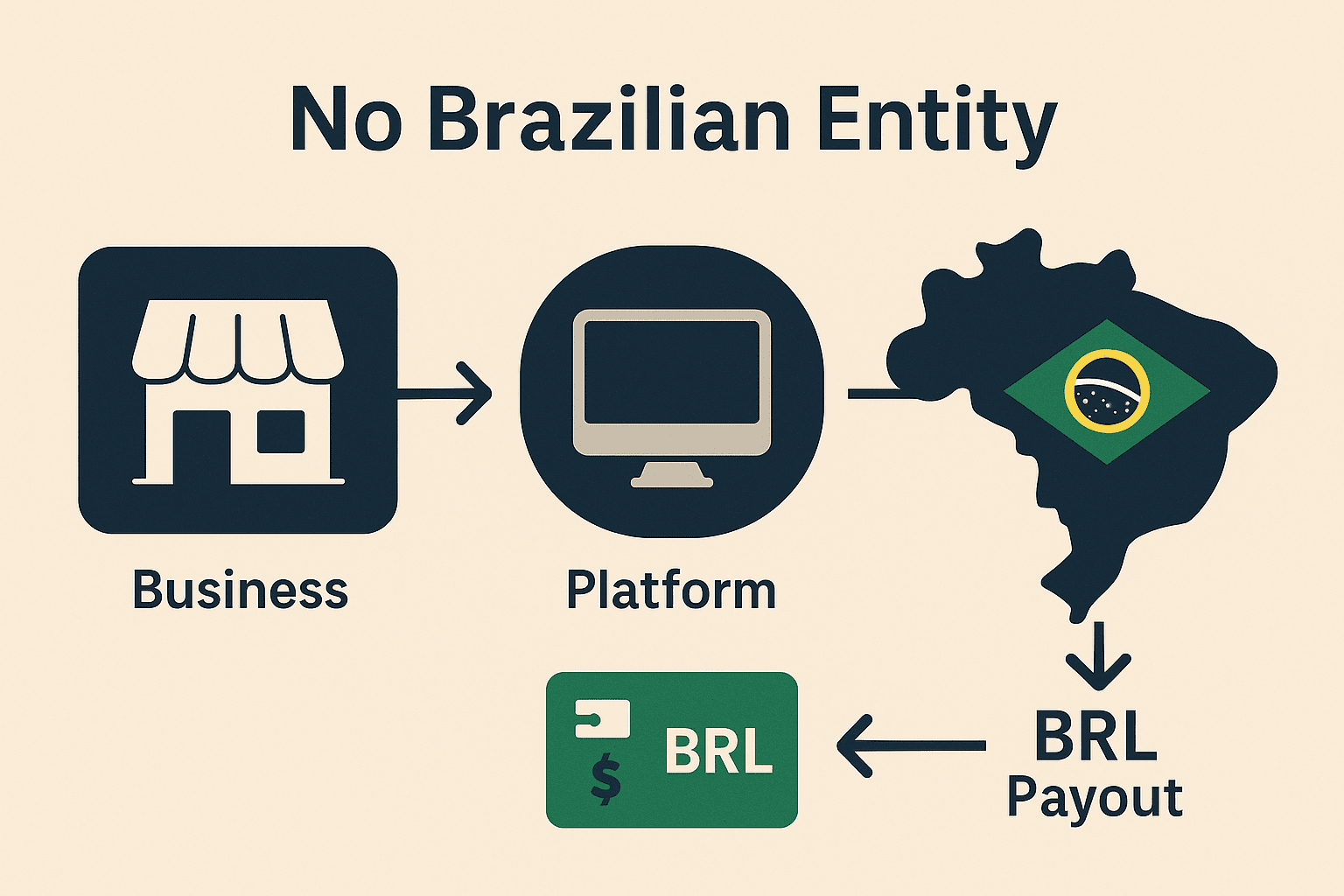

If your business operates outside of Brazil but serves Brazilian customers, getting paid in reais (BRL) can be a major operational headache.

Traditionally, accepting local payments like Pix required a Brazilian legal entity, local tax registration, and integration with a local bank. For many international companies, this barrier meant relying on expensive third-party processors or not serving Brazil at all.

But now, thanks to virtual BRL accounts powered by Yativo, you can collect instant Pix payments from Brazilian users – without a Brazilian company, tax ID, or local bank account.

🧩 The Problem: Getting Paid in BRL as a Foreign Business

If you’re a SaaS company, global marketplace, gaming platform, or fintech serving Brazilian customers, you’ve probably faced some of these challenges:

- ❌ You can’t open a Brazilian bank account without a local entity (LTDA, S/A)

- ❌ Most global PSPs don’t support local Pix payments or settle in BRL

- ❌ SWIFT transfers from Brazil are rare and heavily regulated

- ❌ FX costs and manual reconciliation eat into your margins

Brazil’s Pix payment system is fast, free, and widely adopted but access is largely limited to local players.

✅ The Solution: Virtual BRL Accounts via Yativo

Yativo allows foreign businesses to create virtual BRL receiving accounts that are fully Pix-compatible.

You can:

- Instantly issue Named Pix BRL accounts for your platform or to your users

- Accept Pix payments without a local Brazilian entity

- Convert and settle funds to USDT, USDC, or your local currency

- Reconcile payments using webhooks and metadata

- Manage everything via a single API or dashboard

🔁 How It Works (Step-by-Step)

1. Register on Yativo

Create a business account with Yativo and complete your KYB Process. No local CNPJ required.

2. Generate a Virtual BRL (Pix) Account

For each use case (checkout, invoice, or user), generate a virtual BRL account (Pix Key/QR) with a unique Pix alias.

Example API call:

POST {{baseUrl}} /business/virtual-account/create

{

"currency": "BRL",

"customer_id": "xxxxxxxxx-xxxx-xxxx-b8da-xxxxxxxx"

}

3. Share Pix QR or Alias with Customers

Customers in Brazil can pay you instantly using Pix – the most common payment method in the country.

They simply:

- Scan a QR code

Payment lands instantly in your Yativo BRL or USD balance.

4. Settle to USD or Stablecoins

Once received, you can:

- Convert BRL to USD or USDC/USDT

- Payout to your international bank account or wallet, or that of your customers/suppliers.

- Put the BRL into a stablecoin yield pool and earn rewards

Yativo handles the FX conversion at competitive, transparent rates, and supports near instant payouts to your global accounts.

🔍 Use Cases

| Industry | Use Case |

|---|---|

| SaaS / Apps | Accept subscriptions or in-app purchases in BRL |

| Marketplaces | Collect payments from Brazilian buyers |

| Fintechs | Offer embedded BRL rails to users |

| Education | Charge Brazilian students locally |

| Exporters | Invoice clients in BRL without opening a Brazilian office |

🔐 Why No Local Entity Is Required

Yativo partners with licensed local financial institutions in Brazil to provide compliant access to Pix infrastructure. This means:

- You don’t need a local branch, tax ID, or CNPJ

- You don’t need a local team or contracts with Brazilian banks

- You remain fully compliant while using local payment rails

It’s everything you’d get with a local bank account – minus the paperwork.

📊 Key Benefits of Using Yativo for BRL Collection

| Feature | Yativo |

|---|---|

| Local Pix Account | ✅ |

| No Brazilian Entity Needed | ✅ |

| Real-Time BRL Settlement | ✅ |

| FX to USD or Stablecoins | ✅ |

| Reconciliation Metadata | ✅ |

| API / Dashboard Access | ✅ |

🚀 Final Thoughts

You don’t need to open a company in Brazil to get paid in BRL.

With Yativo, you can issue virtual BRL accounts, accept Pix transfers, and settle globally — with full reconciliation, FX control, and instant collection. Whether you’re launching in Brazil for the first time or scaling existing operations, Yativo gives you the local rails without local red tape.

👉 Get started with BRL virtual accounts on Yativo

👉 Talk to our team to enable Pix payments for your business