What Big Corporations See in Stablecoins, and How Startups Can Take Advantage

Stablecoins have come a long way from crypto chatrooms and trading desks.

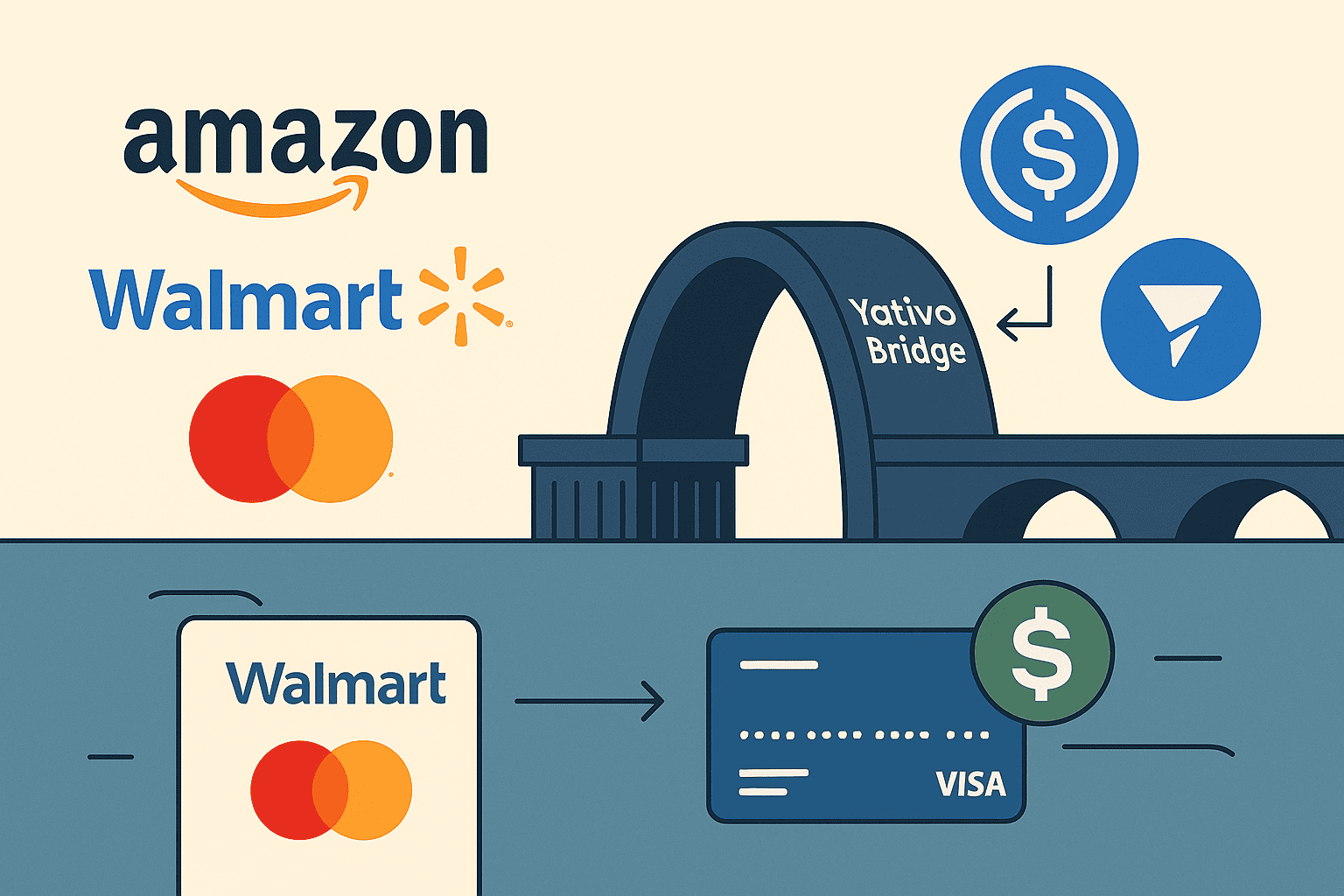

Today, some of the world’s largest corporations including Amazon, Walmart, and Mastercard are actively exploring stablecoin-powered payment rails to improve efficiency, reduce costs, and unlock new markets.

This isn’t a trend. It’s a tectonic shift in how value moves globally.

If you’re a fintech founder, product lead, or payments operator, understanding why these giants are betting on stablecoins could unlock huge opportunities especially as regulatory clarity improves with moves like the U.S. GENIUS Act.

🛍️ Amazon: Instant Settlements and Cross-Border Reach

Amazon has quietly been exploring blockchain-based payments for years. The goal? Faster, cheaper, and more programmable money.

Use cases include:

- Vendor payouts across borders using stablecoins like USDC

- Settling refunds or loyalty credits in real time

- Reducing FX risk for global third-party sellers

Why stablecoins?

- Near-instant finality

- Lower transaction costs than card networks

- Programmable triggers (for refunds, settlement splits, etc.)

Amazon’s interest signals that stablecoins can reduce working capital drag and unlock cross-border growth at enterprise scale.

🛒 Walmart: The Future of Branded Stablecoins

Walmart has already filed patents for its own blockchain-based digital currency essentially a branded stablecoin.

Why?

- Control over in-store and online commerce ecosystems

- Reduce reliance on Visa/Mastercard fee structures

- Power closed-loop loyalty, credit, and installment programs

Imagine a future where:

- Customers are rewarded in “Walmart USD”

- Those tokens can be redeemed, transferred, or saved

- The rails are instant, traceable, and blockchain-native

This shows that even traditional retailers see stablecoins as more than payment, they’re programmable value systems.

💳 Mastercard: Infrastructure, Not Just Settlement

Unlike Amazon and Walmart, Mastercard isn’t replacing its rails, it’s upgrading them.

Mastercard has launched stablecoin onramps, crypto-to-fiat settlement pilots, and integrated support for blockchain-based payment service providers.

Key initiatives:

- Partnering with stablecoin issuers for regulated compliance rails

- Allowing fintechs to settle card transactions in USDC

- Testing stablecoin payments between global subsidiaries

This opens the door for smaller fintechs to build on top of Mastercard-approved flows, with stablecoins as the liquidity layer.

🤔 What Can Fintechs and Startups Learn?

Big players are betting on stablecoins for the same reasons you should:

| Benefit | Impact for Startups |

|---|---|

| ⚡ Speed | Real-time settlement improves UX and treasury efficiency |

| 💰 Cost | Avoid SWIFT, card networks, and costly FX |

| 🌍 Reach | Expand to LATAM, Africa, Southeast Asia without banking licenses |

| 🧠 Programmability | Build smart contracts into payouts, escrow, rewards |

| 🔒 Compliance | Use regulated stablecoins for full auditability |

🛠️ How to Tap Into This Trend with Yativo

You don’t need a blockchain team or custom integrations to take advantage of stablecoins.

With Yativo, you can:

- Accept USDC/USDT from users or partners

- Convert to local currencies (BRL, CLP, MXN, etc.) instantly

- Issue virtual accounts, cards, and invoices powered by stablecoins

- Automate FX and treasury operations via API

- Stay compliant by relying only on regulated stablecoins

Yativo helps you bridge stablecoin liquidity with local financial rails, just like the big players, but without needing a team of lawyers or a bank charter.

👉 Learn how Yativo helps fintechs embed stablecoin flows

🚀 Final Thoughts

If Amazon, Walmart, and Mastercard are exploring stablecoins, it’s not just because it’s trendy, it’s because they see structural advantages.

For startups and fintechs, this is your moment to build:

- Faster settlement

- Cross-border products

- Embedded finance flows

- Programmable money that works across time zones

Stablecoins aren’t the future – they’re happening now.

And with tools like Yativo, they’re accessible to anyone.