Moving money within emerging markets should be simple, but for most businesses, it isn’t.

Whether you’re paying users in Brazil, collecting funds from merchants in Mexico, or sending contractor payments to Vietnam, local bank transfers come with a long list of challenges: fragmented systems, compliance burdens, unpredictable settlement times, and a lack of unified infrastructure.

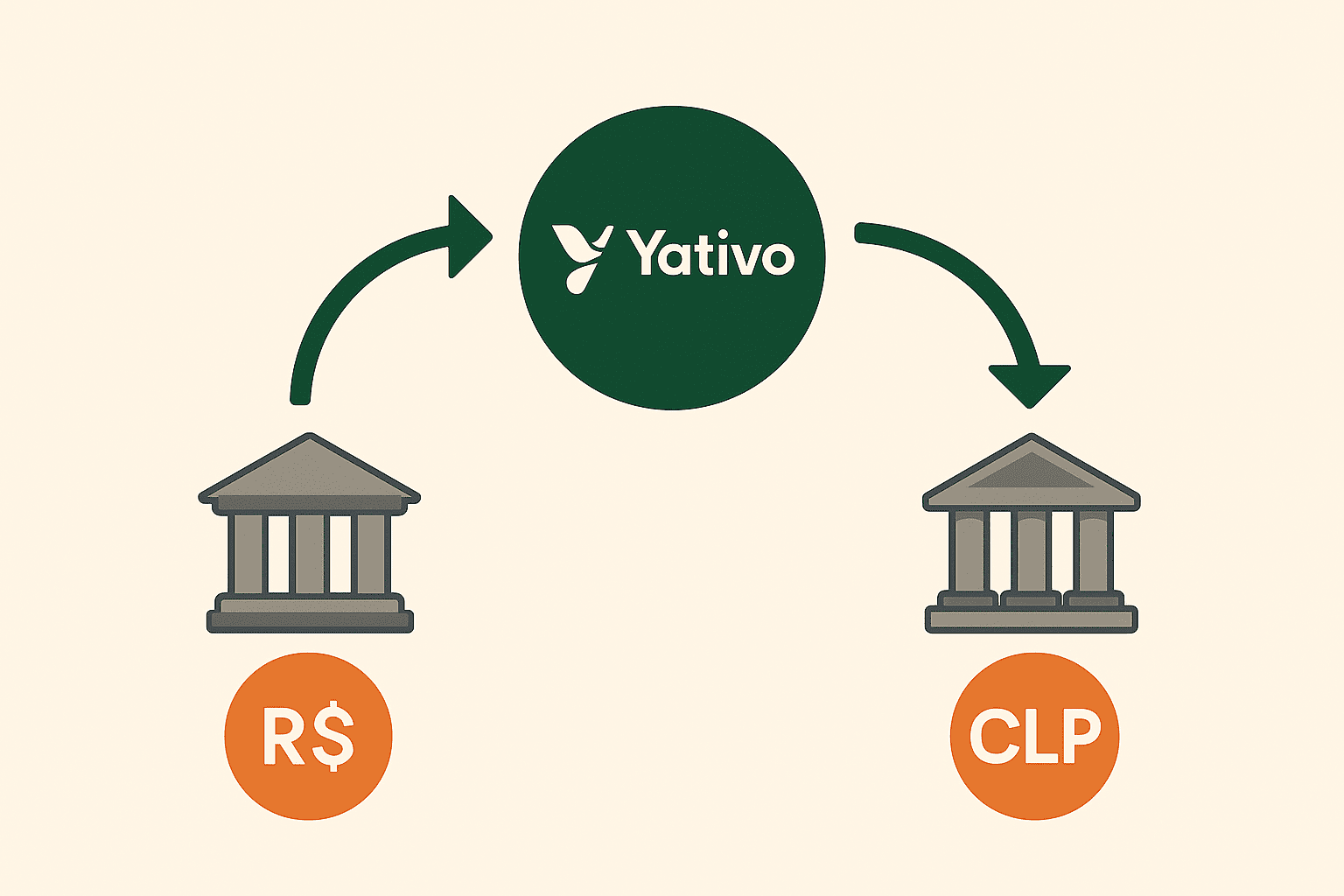

Yativo solves this.

With a single API, you can send and receive local bank transfers across key emerging markets, with instant settlement and full visibility – all without opening local bank accounts.

The Problem: Local Bank Transfers Are a Fragmented Mess

Here’s what businesses face when dealing with domestic payments in emerging economies:

- Multiple formats (Pix in Brazil, SPEI in Mexico, CBU in Argentina)

- Bank-specific validations and exceptions

- No unified reconciliation tools

- Manual KYC and compliance workflows

- Delayed or failed settlements

- Lack of transparency on transaction status

For fintechs, marketplaces, global platforms, and remittance providers, this creates unnecessary risk and operational overhead.

The Yativo Approach

Yativo Checkouts and Payout APIs abstract this complexity by offering:

✅ Unified API for Local Bank Transfers

Initiate, track, and reconcile local bank transfers across multiple countries with one integration.

POST /payouts

{

"country": "BR",

"currency": "BRL",

"amount": 1200,

"beneficiary": {

"name": "Carlos Silva",

"document": "12345678900",

"bank_code": "001",

"account_number": "12345678",

"account_type": "checking"

}

}

Yativo handles validation, compliance, and routing to local clearing systems (e.g., Pix, SPEI, CBU, GCash, etc.).

✅ Instant Settlement via Stablecoins

Fund transfers using USDC or USDT from your Yativo USD wallet, we handle the FX, routing, and payout.

No need for local bank accounts, intermediaries, or pre-funded float in each market.

✅ Real-Time Reconciliation

Get real-time updates on transaction statuses via webhook:

POST /webhooks

{

"event": "payout.completed",

"tx_id": "tx_789456",

"status": "settled",

"timestamp": "2025-06-10T13:24:00Z"

}

Easily map deposits and withdrawals back to user accounts or invoices.

✅ Embedded KYC & Compliance

Yativo ensures every transfer complies with local AML/KYC rules. You don’t need to build country-specific identity checks or licensing frameworks — it’s handled for you.

✅ Multi-Market Coverage

Yativo supports domestic transfers across key emerging markets, including:

- 🇧🇷 Brazil (Pix)

- 🇲🇽 Mexico (SPEI)

- 🇨🇱 Chile (CuentaRUT, bank accounts)

- 🇦🇷 Argentina (CBU/ALIAS)

- 🇵🇭 Philippines (GCash, Instapay)

- 🇻🇳 Vietnam (NAPAS, VietQR)

- … and expanding

Use Case Examples

| Business | How Yativo Helps |

|---|---|

| Remittance Platform | Collect in USD, settle locally via Pix/SPEI/CBU |

| Freelancer Marketplace | Pay contractors in LATAM and Southeast Asia without local bank accounts |

| Crypto Wallet | Allow users to off-ramp stablecoins to local bank accounts |

| Neobank | Launch without needing local PSP licenses or settlement partners |

| E-commerce Platform | Accept local bank transfers and settle in USDC or to vendors directly |

Why It Matters

Businesses operating in emerging markets can’t afford liquidity gaps, failed payouts, or regulatory mistakes. Yativo bridges the gap between crypto liquidity and local payment rails, giving you the power to move money quickly, reliably, and at scale, all through one integration.

Final Thoughts

Local bank transfers in emerging markets don’t have to be painful. With Yativo, you get unified access to regional payment systems, instant FX-settled payouts, and built-in compliance, all powered by stablecoins.

No bank accounts. No settlement delays. No fragmented systems.

👉 Explore Yativo Checkouts & Payouts

👉 Talk to our team to integrate local transfers into your platform