Whether you’re a European fintech, a global marketplace, or a remote-first company paying contractors, sending business payments to Latin America can be frustrating.

SWIFT transfers are slow. Bank fees are unpredictable. Settlement is often delayed. And local recipients may not even have access to USD or EUR accounts.

But there’s a faster way.

This guide explains how to send B2B or B2C payments from Europe to Latin America, and how platforms like Yativo make it easier using local rails, stablecoins, and a single API.

The Traditional Problem

Sending money from Europe to LATAM using traditional banks often means:

- 3–7 day settlement times

- €20–€50 per transfer in bank fees

- Additional FX margin on conversion

- SWIFT failures due to missing recipient details

- Recipients waiting days for confirmation

- Poor visibility into transaction status

For global businesses handling payroll, vendor payments, or cross-border commerce, this creates friction, lost time, and added cost.

What You Actually Need

To send business payments efficiently to LATAM, you need:

- ✅ Fast settlement (same-day or instant)

- ✅ Transparent FX rates

- ✅ Local currency delivery (BRL, MXN, CLP, ARS, etc.)

- ✅ Reliable KYC and bank validation

- ✅ Scalable API or bulk payout tools

- ✅ EUR → Stablecoin → Local Currency routing, all-in-one

This is where Yativo comes in.

How Yativo Works

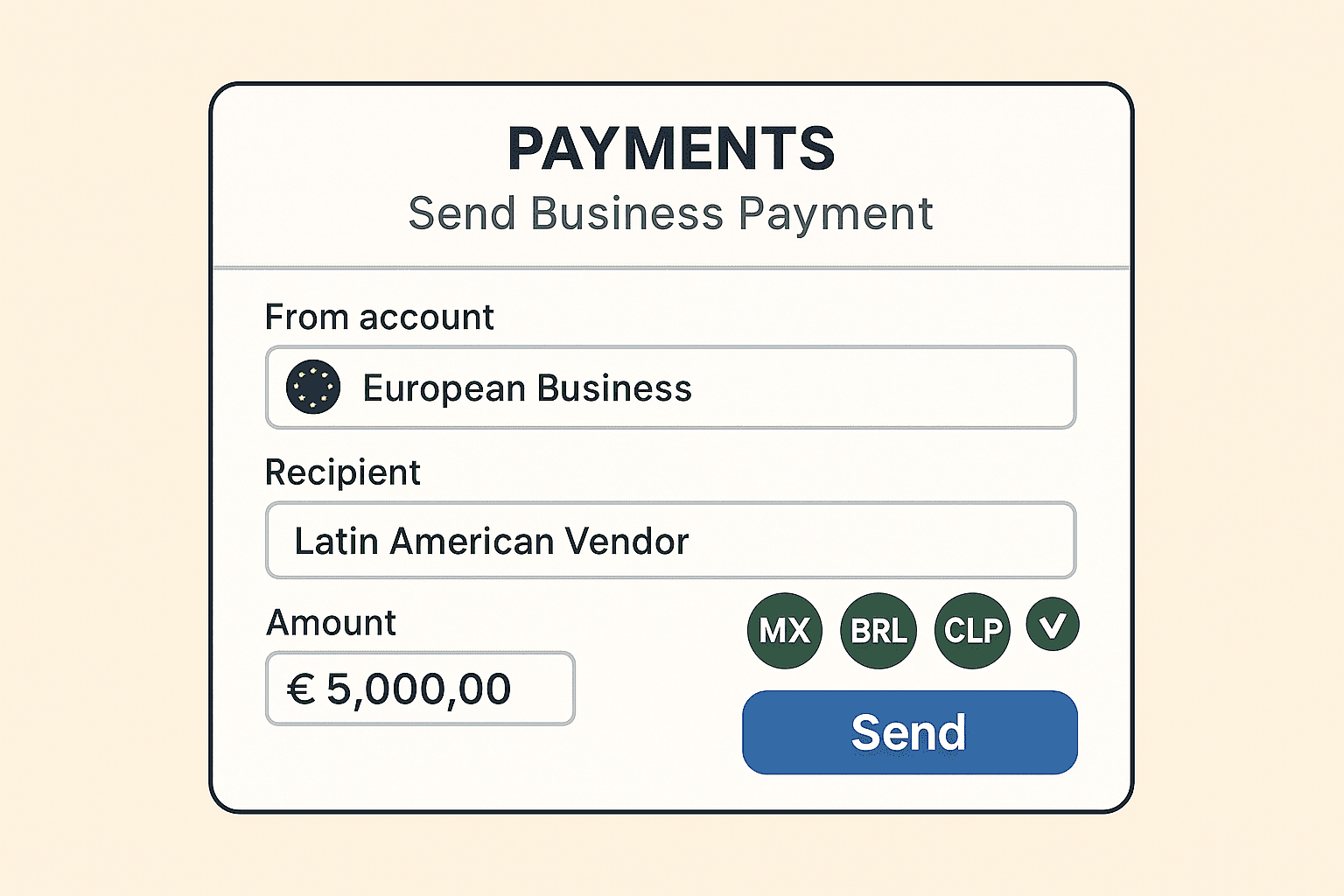

Yativo enables companies to move funds from Europe into Latin American markets using stablecoins and local rails, without needing local bank accounts or SWIFT infrastructure.

Step-by-Step Flow: EUR to LATAM

- You send EUR to Yativo’s designated IBAN in Europe

- Funds are auto-converted to Stablecoins (EURC, USDC, USDT)

- Yativo offramps the stablecoins to LATAM via local rails:

- Pix (Brazil)

- SPEI (Mexico)

- TEF (Argentina)

- Interbank transfers (Peru)

- Nequi / Daviplata / bank accounts (Colombia)

- Recipients receive local currency (BRL, MXN, etc.) in minutes

- You get real-time updates and CSV reports

Example: Paying a Developer in Mexico

Let’s say your company in Berlin is paying a Mexican engineer €1,000.

Without Yativo

- EUR sent via SWIFT

- 3–5 day delay

- Recipient gets MXN, minus fees and poor FX rate

- No webhook or automation

With Yativo

- You fund via SEPA in EUR

- Funds are converted to EURC/USDC and then to MXN

- Yativo settles to their SPEI account in real-time

- You get transaction status via API or webhook

- FX is transparent, and fees are low

Why Yativo is Built for LATAM Payments

| Feature | Benefit |

|---|---|

| Stablecoin rails | Avoid SWIFT and move money faster |

| Unified API | Pay into 6+ LATAM markets with one integration |

| Transparent FX | See rates before executing |

| No need for local bank accounts | Operate cross-border instantly |

| Real-time webhooks | Full transaction visibility |

| KYC & compliance built in | No extra burden on your team |

Use Cases

- ✅ Freelancer & contractor payroll

- ✅ Marketplace vendor payouts

- ✅ Affiliate and creator payments

- ✅ Global fintech treasury

- ✅ B2B invoice payments to suppliers

Final Thoughts

If your business is sending funds from Europe to Latin America, don’t let outdated banking infrastructure slow you down.

With Yativo, you can fund in EUR, settle in local LATAM currencies, and manage everything from a single dashboard or API — with faster settlement, lower fees, and better transparency.

👉 Get started with Yativo Payouts

👉 Contact us to integrate LATAM payments into your platform