If your company earns revenue in Mexico but operates from the U.S., you’ve likely run into this challenge:

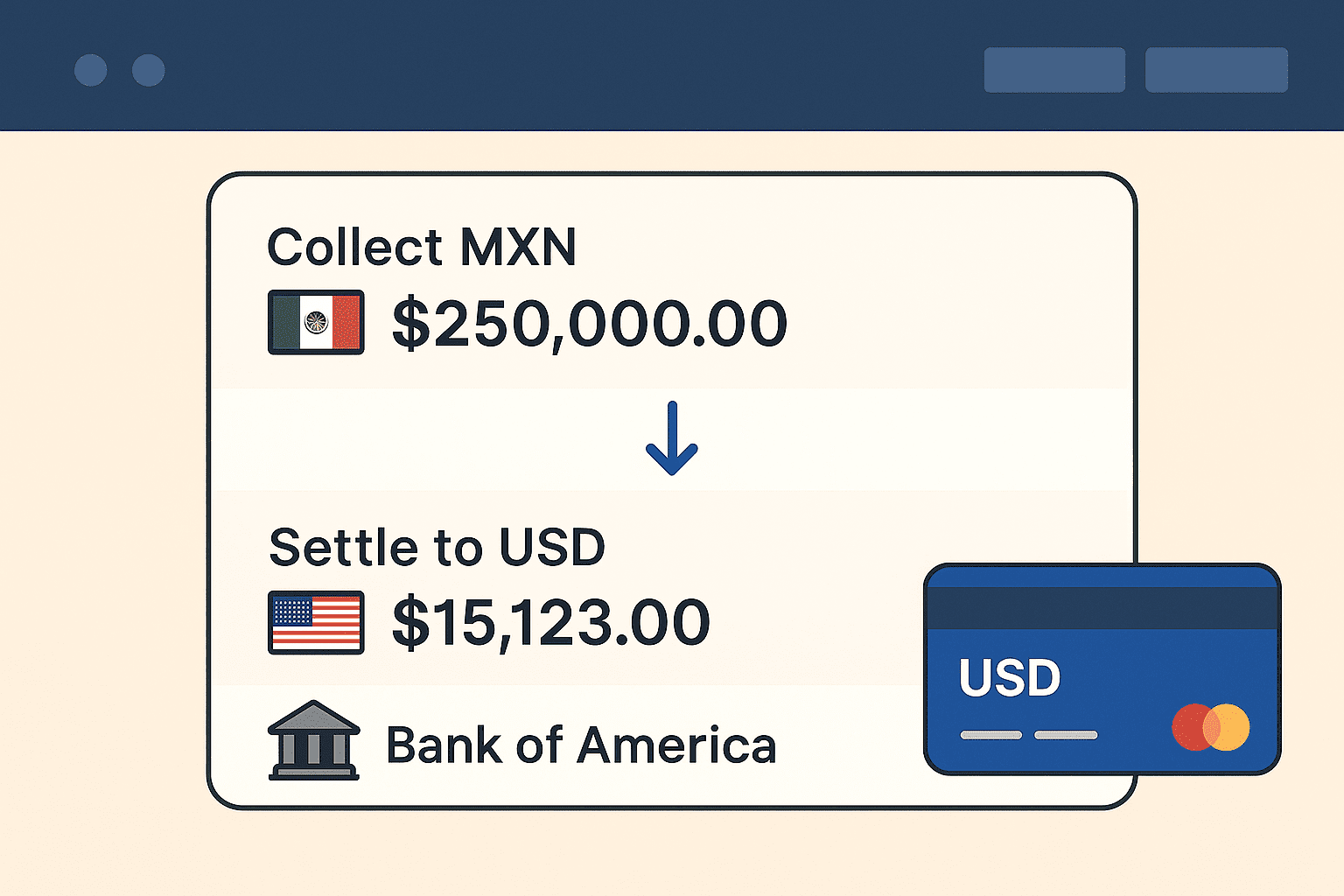

How do you collect customer payments in Mexican pesos (MXN) and settle the funds in U.S. dollars (USD), without opening a Mexican bank account?

Whether you’re running a SaaS platform, collecting vendor commissions, or offering cross-border services, traditional collection methods are slow, expensive, and hard to reconcile.

This guide breaks down how to do it the right way and how Yativo makes it simple using named CLABEs, local bank rails, and instant USD settlement.

The Problem with Cross-Border Collection

Collecting MXN and settling to USD is harder than it sounds. Here’s why:

❌ Most U.S. banks can’t receive MXN

They only handle USD or EUR, which means you need a local MXN account or a third-party processor.

❌ Currency conversion is expensive and opaque

You’ll likely lose 3–5% of revenue in FX spreads or fees plus delays in reconciling which customer paid what.

❌ Manual reconciliation is painful

If 10 customers pay the same amount, how do you know who paid you? Standard collection accounts don’t offer payment-level traceability.

What You Actually Want

✅ A local MXN collection account in Mexico

✅ Automated reconciliation per customer or transaction

✅ Instant FX conversion with transparent rates

✅ USD settlement to your U.S. bank account or stablecoin wallet

✅ No need for a Mexican bank account or tax ID

How Yativo Makes It Easy

Yativo Virtual Accounts lets your business collect MXN using local SPEI bank transfers, and settle to USD in the U.S., all through a unified API or dashboard.

1. Generate a Unique CLABE for Each Payment

For every transaction or customer, Yativo issues a unique, named CLABE account. This allows:

- ✅ One-to-one matching of deposits

- ✅ Real-time reconciliation

- ✅ Easier automation of invoicing and accounts receivable

Example:

| Customer | CLABE Issued |

|---|---|

| Juan Martinez | 646180157000012345 |

| Acme S.A. de C.V. | 646180157000067890 |

Each CLABE is mapped to metadata like invoice ID, user ID, or transaction type.

2. Customer Pays in MXN via SPEI

Your customer pays to the issued CLABE using Mexico’s SPEI system, the country’s real-time interbank transfer network.

Funds are received instantly and matched to the correct transaction or account.

3. Yativo Converts MXN to USD

Once the funds arrive:

- Yativo converts MXN to USD using real-time FX rates

- You can choose to convert automatically or on a schedule

- You see full transparency on rates, fees, and conversion time

4. USD Settled to You in the U.S.

After conversion, Yativo:

- Credits your USD balance (in USDC, USDT, or fiat)

- Or sends funds to your U.S. bank account

- Provides webhooks and transaction records for your internal systems

Why This Matters

| Challenge | Yativo Solves It |

|---|---|

| Multiple incoming payments | Unique CLABEs with automatic reconciliation |

| Currency conversion risk | Real-time, transparent FX |

| Lack of local entity | No Mexican company or bank account needed |

| Delays in receiving USD | Same-day or next-day USD settlement |

Use Cases

- SaaS platforms billing Mexican clients in MXN

- Marketplaces collecting commissions from vendors

- Exporters receiving payments from Mexican buyers

- Fintechs or PSPs building embedded collection flows

- Crypto platforms off-ramping from MXN to USDC

Final Thoughts

If your company earns in MXN but operates in USD, there’s no need to juggle Mexican bank accounts, SWIFT wires, or manual spreadsheets.

Yativo’s named CLABEs, local collection rails, and stablecoin-enabled settlement make it easy to collect, reconcile, convert, and withdraw – all from one platform.

👉 Explore Yativo Payouts

👉 Talk to our team to activate MXN collection with USD settlement