The essential infrastructure layers for global money movement

Cross‑border payments are one of the most complex, regulated, and high‑stakes problems in fintech. Moving money across borders requires stitching together a patchwork of local banking rails, FX providers, compliance systems, and settlement mechanisms while ensuring speed, reliability, and low cost.

For fintech builders, the question isn’t just how do I move money from A to B? but what stack do I need to build a scalable, compliant cross‑border payments platform?

Here’s a breakdown of the fintech stack for cross‑border payments, from the core plumbing to the customer experience and how platforms like Yativo provide these rails out of the box.

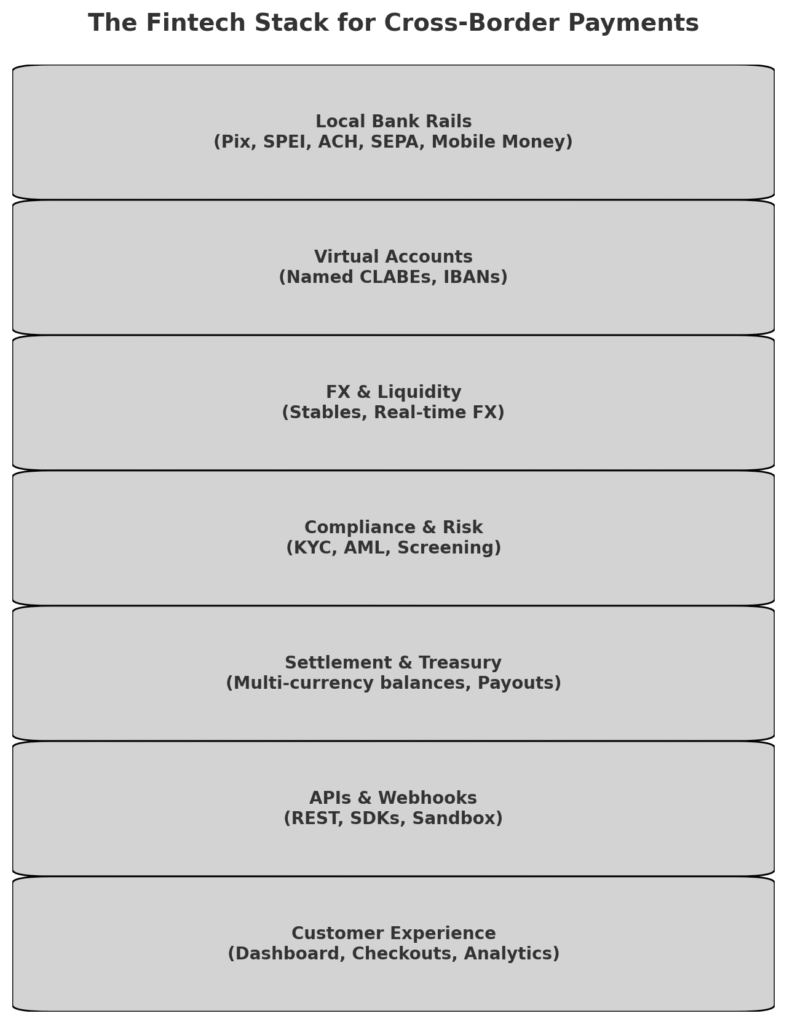

🔑 1. Local Bank Rails Integration

Every cross‑border transaction starts and ends with local payment rails. Whether it’s:

- Pix in Brazil

- SPEI in Mexico

- ACH in the U.S.

- SEPA in Europe

- Mobile money in Africa

A payments platform must integrate directly with these systems to allow collections and payouts. Without local rail access, you’re forced to rely on intermediaries, adding cost and delays.

Yativo’s approach:

API‑driven integration with local systems like Pix, SPEI, and PSE, enabling instant payments in emerging markets.

🔑 2. Virtual Accounts & Named Accounts

For reconciliation and user trust, platforms need virtual accounts in multiple currencies. These accounts act like local bank accounts, allowing businesses to:

- Receive payments in local currencies

- Assign unique identifiers (CLABEs in Mexico, IBANs in Europe) for each customer or transaction

- Simplify reconciliation and auditing

Yativo’s approach:

Generates unique, named CLABEs for every transaction or customer in Mexico, making reconciliation easy and automated.

🔑 3. FX & Liquidity Layer

The heart of cross‑border payments is foreign exchange. Without efficient FX:

- You pay higher spreads (2–5% at banks)

- Suppliers or customers receive less

- Treasury management becomes unpredictable

The FX layer must include:

- Real‑time FX quotes

- Liquidity management across currencies

- Hedging tools for volatility

Yativo’s approach:

Uses stablecoins (USDC, USDT) as a liquidity layer. For example:

CLP → USDT → CNY/SGD/HKD → Local payout

This ensures faster settlement and lower FX spreads.

🔑 4. Compliance & Risk Infrastructure

No cross‑border platform survives without compliance. You need:

- KYC/KYB: Screening users against sanctions and PEP lists

- AML Transaction Monitoring: Detecting suspicious patterns

- Crypto Transaction Screening: For wallets and on‑chain flows

- Regulatory Reporting: Filing SARs/STRs where required

Yativo’s approach:

Built‑in compliance stack with ShuftiPro & Dojah (identity), Chainalysis (crypto wallet & transaction screening), and risk scoring for customer tiers.

🔑 5. Settlement & Treasury Management

Once funds are collected and converted, they need to be settled to the right place at the right time. This requires:

- Multi‑currency balances

- Automated treasury routing

- Payout scheduling and batch execution

- Cash management dashboards

Yativo’s approach:

Treasury APIs that allow businesses to hold balances in USD, stablecoins, or local currencies, and trigger settlements automatically.

🔑 6. Developer Experience (APIs & Webhooks)

Modern fintech isn’t built by hand; it’s built via APIs. Developers need:

- REST APIs for initiating payments, issuing accounts, and tracking transactions

- Webhooks for real‑time updates (payment received, payout executed, FX confirmed)

- SDKs and sandbox environments for rapid integration

Yativo’s approach:

Provides a developer‑first experience, with full API documentation and webhook support to embed cross‑border payments in any platform.

🔑 7. Customer Experience Layer

At the top of the stack, all of this infrastructure must be wrapped in an intuitive interface:

- Dashboards for finance teams

- Branded portals for end users

- Payment links and checkout pages

- Reporting and analytics tools

Without this, businesses see payments as “black boxes” rather than transparent flows.

Yativo’s approach:

Offers a unified dashboard for CFOs and operators to track payments, reconcile accounts, and export reports plus an API to embed payments into existing ERP or SaaS systems.

🚀 The Full Fintech Stack in Action

Here’s what a cross‑border payment might look like using this stack:

- A Chilean business generates a virtual USD account on Yativo.

- A U.S. customer pays into that account.

- Yativo converts USD to USDC, then routes liquidity through global partners.

- Funds are off‑ramped to BRL via Pix, MXN via SPEI, or CNY via local rails in China.

- Compliance checks, FX rates, and settlement details are logged automatically.

- The business sees a reconciled, transparent payout in its dashboard.

✅ Final Thoughts

Building a cross‑border payments platform from scratch requires a complex fintech stack: local rail integrations, FX liquidity, compliance, treasury, APIs, and customer‑facing tools.

With platforms like Yativo, you don’t need to rebuild this stack. Instead, you can leverage infrastructure purpose‑built for emerging markets — combining stablecoin liquidity, local rails, and full compliance into one API‑driven layer.

👉 Explore Yativo’s payments infrastructure

👉 Talk to our team about embedding global payments in your fintech