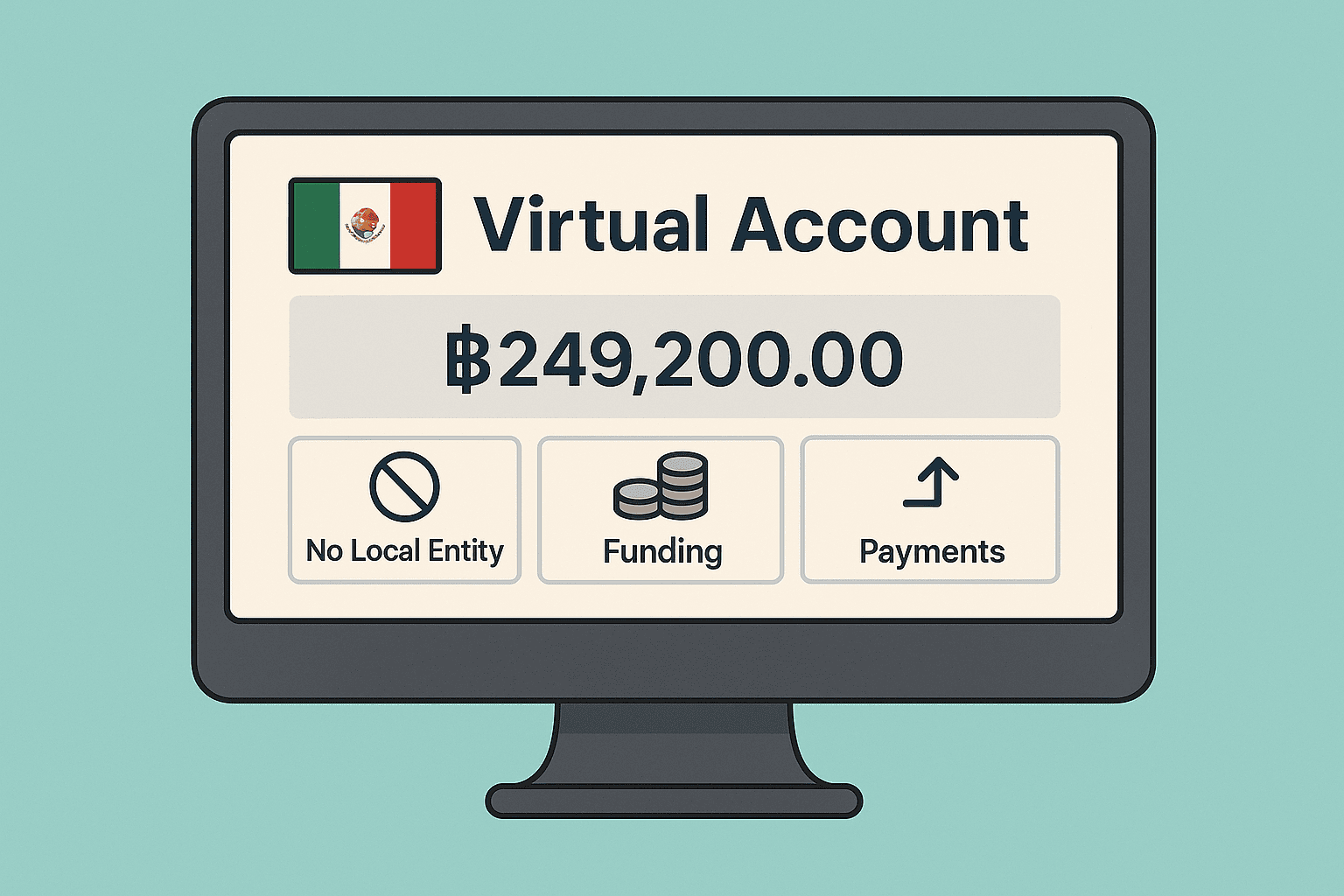

Expanding into Mexico is a smart move for fintechs, payment platforms, and global apps. But there’s one major hurdle that stops most companies:

Your users want a way to receive or collect money in Mexican pesos (MXN), but don’t have a legal entity or bank account in Mexico.

Traditionally, that meant months of paperwork, tax registrations, and regulatory complexity.

But now, with virtual account infrastructure from platforms like Yativo, you can issue MXN bank account numbers (CLABEs) to your users instantly, without a local entity or Mexican tax ID.

Why Virtual MXN Accounts Matter

Virtual accounts make it easy to:

- ✅ Accept payments via SPEI (Mexico’s real-time bank transfer system)

- ✅ Assign a unique bank account number (CLABE) to each user, customer, or transaction, in the name of your client

- ✅ Automate reconciliation with payment-level tracking

- ✅ Offer a seamless local collection experience in MXN

They function like real Mexican bank accounts, but are issued under a licensed partner and routed through a master settlement account. No local incorporation needed.

What’s the Catch with Traditional Banks?

If you tried to do this directly through Mexican banks, you’d typically need:

- A Mexican legal entity (S.A. de C.V. or S.A.P.I.)

- An RFC tax registration

- Local directors or reps

- Compliance infrastructure under CNBV (the financial regulator)

- 3–6 months of legal and setup time

That’s fine for a large multinational. But for most startups and platforms, it’s too much overhead just to receive MXN.

The Yativo Approach: Named CLABEs Without Borders

Yativo lets you issue named CLABEs to users through a simple API, without needing a Mexican bank account or legal presence.

Each CLABE:

- Is tied to a specific user or transaction

- Accepts payments via SPEI

- Is fully traceable and reconciled in your dashboard or backend

- Can be held as to MXN, or auto-converted to USD/USDC/USDT upon receipt

How It Works (Step by Step)

1. User Onboards to Your Platform

You register the user on your platform, and handle their KYC/KYB, as need be.. You can relay this info to us via API.

2. Generate a Virtual CLABE via API

You call the Yativo API to create a virtual MXN receiving account:

POST /business/virtual-account/create

{

"currency": "MXN",

"customer_id": "xxxxxxxxx-xxxx-xxxx-b8da-xxxxxxxx",

}

Yativo returns a unique CLABE, which you can display in your dashboard or share with your user.

3. Customer Pays via SPEI

Funds are sent from any Mexican bank to the issued CLABE. The transfer is:

- ✅ Real-time (SPEI works 24/7)

- ✅ Trackable

- ✅ Matchable to a specific user or purpose

4. Settlement and Conversion

Once the funds arrive:

- You can hold them in MXN, or

- Convert to USD, USDC, or USDT for payout, treasury, or reconciliation

- Funds appear in your Yativo USD or MXN balance, ready for use or withdrawal

You’ll receive a webhook like:

{

"event": "deposit.settled",

"clabe": "646180157000012345",

"amount": 5,000,

"currency": "MXN",

"user_id": "user_123",

"timestamp": "2025-06-10T18:42:00Z"

}

Use Cases

| Business Type | Use Case |

|---|---|

| Freelancer Platforms | Let users receive client payments in MXN |

| SaaS Companies | Collect local subscriptions via SPEI |

| Crypto Platforms | On-ramp MXN → USDC from user accounts |

| B2B Marketplaces | Accept buyer payments and settle to vendors |

| Exporters / Importers | Get paid locally in MXN, reconcile globally in USD |

Why This Works

| Traditional Method | Yativo |

|---|---|

| Requires local entity | No |

| Long bank onboarding | Instant via API |

| Manual reconciliation | Unique CLABEs for automation |

| Local bank account required | No, pooled and managed via Yativo |

| Limited FX control | Real-time rates, programmable conversion |

Final Thoughts

Issuing Mexican peso virtual accounts no longer requires setting up a company in Mexico, opening a local bank account, or dealing with months of compliance headaches.

With Yativo, you can offer your users SPEI-enabled CLABE accounts with full control over reconciliation, FX, and settlement, all through a simple API.

👉 Explore Yativo Virtual Accounts

👉 Contact us to issue CLABEs without borders